“One thing that we haven’t talked about student loan forgiveness is the impact of student loan forgiveness (plans) by employers. Typically, these are white collar employers.

I like this concept because people can choose where they work and companies would have to compete for employees.

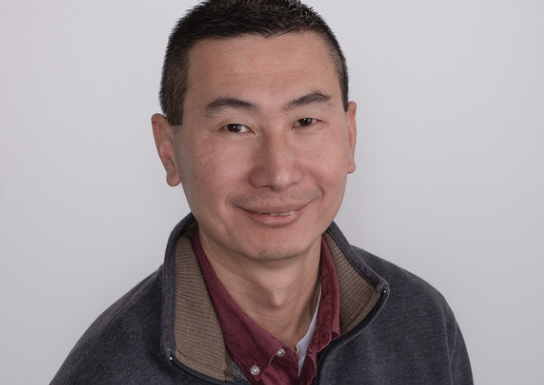

Perhaps one of the solutions is that the framework for student loan forgiveness is setting up the framework to help businesses offer this benefit.” Jack Wang

In order for me to support my blogging activities, I may receive monetary compensation or other types of remuneration for my endorsement, recommendation, testimonial and/or link to any products or services from this blog. Please read my disclosure here.*

If you’re looking for some guidance on what to do with your student loans and you need an outside perspective on what your options are, Student Loan Planner may be the resource for you. Schedule a paid consultation with one of Student Loan Planner’s, student loan consultants who will walk you through what your options are. Student Loan Planner has a 99% satisfaction rate and a whole person focused approach when helping clients.

If you’re worried about saving for retirement, going on vacation and the impact of your student loan repayment on those goals, Student Loan Planner consultants understand and respect those concerns and keep that in mind while working with you. Please note “If you’re listening to this episode in 2022 you have until October 31, 2022 to submit your Public Service Loan Forgiveness waiver” I’m proud to partner with Student Loan Planner and if you’re interested in scheduling your student loan paid consultation go to the following link:

https://michelleismoneyhungry.com/studentloanplan today

Finally, I would like to thank the Plutus Foundation for its support of the Michelle is Money Hungry Podcast. “The Plutus Foundation supports financial content creators with grants, networking, learning events, and podcasts. Twice a year, we provide grants for financial literacy projects of all types. The foundation highlights excellence through the Plutus Awards, and you can see how you can make a bigger impact with your audience at Plutus Voices and the Plutus Impact Summit. Go to plutusfoundation.org for more information.”

Please note: Michelle is Money Hungry is for entertainment purposes only. Content should not be considered financial advice and listeners are encouraged to do their due diligence.

Welcome to Michelle is Money Hungry, a podcast that has real and empathetic conversations that often focus on the intersection of policy and the financial conversations we’re afraid to have. I’m your host, Michelle Jackson and this summer I’m having conversations all about the potential for student loan forgiveness and what will happen if we move forward with the policy and what happens if we don’t.

Listen to the Show

Show Notes

- Jack-I help families whose students are trying to pay for college. I also work with students and families who are out of college and are trying to pay off and manage their student loan debt.

- Michelle-Could you share some of the strategies that you share with families? And, how did you get into this field?

- Jack-I was dealing with my own personal experience. I was getting divorced when my children were going to college. I basically knew what most people knew about paying for college. I was asking people for help because I needed help. You don’t know what you don’t know. You wouldn’t even know what questions to ask. That’s how I got started. Colleges are businesses, but it doesn’t lessen the need for them needing paying customers. The bottom line-the more the school wants your student, the more money they will give.

- Michelle-What kind of aid are you talking about and what kind of aid is out there? How are parents who aren’t working with you supposed to have a gage of what to ask?

- Jack-We’ve all heard the following “Hey, fill out the FAFSA.” The FAFSA largely governs Federal Student Aid. But, roughly 2/3’s of that aid is in the form of loans. While loans can be helpful tools, I don’t necessarily consider that aid because you have to pay it back. You’ll find that colleges offer more aid than the Federal Government. Good news-there’s a lot of aid out there. Bad news-you have to follow the school’s rules. There are thousands of schools.

- Michelle-If I’m a mom right now, how do I understand the “and then what?” The next step in finding aid for the college that my child wants to attend. How do I know what question I should ask?

- Jack-The question that parents should ask is pretty simple. The question that’s never asked “What do you need to get a scholarship?”

- Michelle-I like that we started this conversation from the incoming student conversation. But, as we have this conversation it’s becoming clear that the Biden Administration is going to cap out the aid at $10,000 vs. $50,000. There seems to be many different conversations umbrellaed under this conversation. How do we avoid being in the place that we’re in now? The context of this series, in the immediate sense, we’re talking about adults who’ve had a negative experience with student loans. What’s your view on the potential for a student loan forgiveness program.

- Jack-Student Loan Forgiveness whether it’s $10,000 or $50,000 there’s so many aspects to it. What happens to the people who paid off their loans prior to this policy? The second thing I think about is how would this be implemented. Most people don’t just have one loan, but they have several loans. There’s a practical aspect to this process that needs to be work through. I truly do worry about the unintended consequences for future students. The devil’s in the details.

- Michelle-I’m thinking that there may be room to create some type of benefit for recent repayments. Similar to the electric bike credit it Denver. Is there a way to assist people and incentivize them in a different way. Similar to the $8,000 downpayment program that President did for homeownership.

- Jack-We have some types of programs right now via the Public Service Loan Forgiveness program. There’s also the Teacher’s Loan Forgiveness program. Main also has a STEM focused program.

- Michelle-Things feel unnecessarily complex depending on where people live. What are some of the stories that people share about being advised on what paying for college looks like.

- Jack-I do hear about that quite a bit. It’s pretty consistent that people basically got no guidance. They’re told what they can do versus what they should do.

- Michelle-If you were tasked with fixing this cost of college/improve the system for future students?

- Jack-There is a guardrail in most lending doesn’t exist for student loans. Parent plus loan is an example of this with essentially no credit check.

- Michelle-Schools are finding solutions related to this problem.

- Jack-How do we not end up here again is the biggest problem. Ego plays a huge role in this. (related to what schools people attend) Is this really just a bandaid?

- Michelle-What’s really interesting to me that everyone in this series had the same solutions. It’s wild to me. All of you kind of talked about similar concerns and solutions at the heart of dealing with this problem.

- Jack-I think that focusing on student loan forgiveness is the wrong problem to solve. The right problem to solve is to restructure how higher ed operates and how it’s paid for. Not necessarily a European model. My mission is to help pay for college without having to take on a lot of debt.

Jack Wang

- Jack Wang Innovative Advisory Group

Latest posts by Michelle (see all)

- How to Design a Boycott Strategy That Works for YOU - 6 February, 2025

- How Work Policies Against Black Women Birthed a Love of the Soft Life - 20 March, 2024

- How Taylor Swift’s IP Victory Could Change the Business of Music - 28 February, 2024