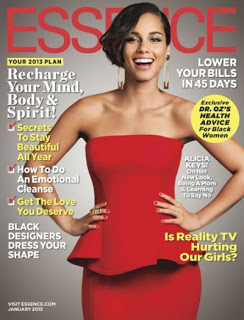

I subscribe to two magazines: Whole Living and Essence. Every month it’s like Christmas, you never know what fun stories, amazing fashion, and life tips will be included in that month’s edition. With that in mind I was really excited to receive the December edition of Essence. As I flipped the pages and drank in clothing, hair, and suggestions on new books to read the magazine was about to hit a home run with me. Then, I read the following article “The Credit Doctor Is In.” I don’t claim to be a professional financial advisor but this article really pissed me off. Basically, the article started off really well. Discussing the concept of good credit and taking steps to clean up any credit issues that you may currently be dealing with. Then, it ended on a really sour note for me.

Steps as mentioned in the article:

1.) Dispute credit report errors-this was followed with some great tips on beginning the process of cleaning up your credit report

2.) Contact creditors directly-as a part of the dispute process when erroneous information is being reported. Totally made sense to me and I wrote down the advice.

3.) Pay down revolving debt-got it! As this is an article about cleaning up credit this made a lot of sense to me. This step mentioned being below the 30% available credit usage threshold.

4.) Increase credit limits-What the??? Why on earth should anyone be encouraged to do this if they are in the process of cleaning up their credit? This is not the time to add more possibilities to go into debt.

4.) Add unsecured or secured credit cards-WHAT!! Now, I’m really getting pissed. Again, why is the writer encouraging readers to get further into debt? The last time I checked, the higher my credit limits the more I spent.

5) Become an authorized credit card user-You have officially enraged me and now I am writing a blog post because I can’t believe this! Why in the hell should I be encouraged to allow someone who has trouble managing their own debt to be an authorized user on my credit card? Exposing me to the very real risk of messing up my credit? If a credit card issuer won’t give them a card, why in the heck are they being encouraged to be on mine? And to be honest, if I am my own personal credit hazard, why should I be encouraged to spread my disaster into someone else’s life?

I love Essence Magazine, but I found this specific article truly irresponsible. I would have enjoyed reading about steps on cutting out bad habits that are enabled through the availability of credit. Or, learning how to save money and using that skill to eliminate credit usage. It also would have been nice to have information on money/credit coaching organizations that readers could get in touch with. These organizations could help the readers to identify strategies to eliminate relying on credit and develop money building skills. Essence, you can do better than this and I look forward to next month’s edition.

Latest posts by Michelle (see all)

- How Work Policies Against Black Women Birthed a Love of the Soft Life - 20 March, 2024

- How Taylor Swift’s IP Victory Could Change the Business of Music - 28 February, 2024

- Why Don’t More Personal Finance Content Creators Talk About Policy - 16 January, 2024

Hi, first time leaving a comment here but I thought I’d discuss the Essence writer’s article.

1.) Increasing your credit limit means increase the amount of credit that you are eligible to borrow. What this does is increase your credit score because it makes your ratios look better (available credit vs what you have borrowed etc…). While I agree that it makes sense, it kind of takes out the human element. A person that’s in debt debt might have troubles resisting the temptation, but for the average credit card holder it might be a good thing.

On the last two, I totally agree unless you are just starting out trying to establish a credit history. I would do this for my kids, but that’s it.

Perhaps the author of the Essence article should have created a steps for different credit scenarios… One size doesn’t fit all 🙂

Great new look for your site!

Hi Don,

Thank you for your comment. I actually re-read the article a couple of times before writing my post. I agree that the idea of increasing your credit limit could increase your credit score regarding credit ratios. And one size definitely doesn’t fit all. Thank you so much for the compliment on my site. Denver Eric really helped me out! I’m hoping Essence steps it up next month.

Happy New Year,

Michelle 🙂