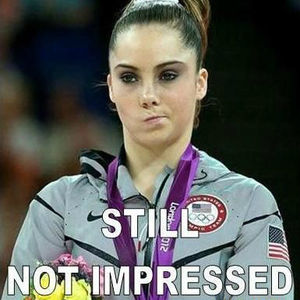

Meh.

The other day I was looking at my MINT.com account. I try to do this about once a week. I’m trying to make sure that I’m updating where I’ve spent my money. I also like to see my debts slowly decreasing month after month. Nowadays I have a lot fewer debts so I get kind of excited when I look at my accounts.

Recently I’ve watched my accounts with a lot more interest because they have been inching towards the 6 figures mark. Earlier this year I wrote a post about having a net worth that was more than $5 dollars. Why $5 dollars? Because black women have been the subject of numerous studies that suggest our average net worth is $5 dollars.

$5 Dollars, Five Freaking Dollars

When I first heard this statistic it broke my heart. But I understood that the daily reality for a lot of women of color is the following: struggle to deal with lower wages, a pursuit of higher education, financially helping family, and dealing with high levels of stress attributed to all of these situations. Then, you add weight gain because of the stress and it’s an endless cycle. I am basing these suppositions on my observations of people that I know, what I’ve read, and my own experiences.

I’ve gained weight, dealt with too may stressful situations, and accumulated a ton of debt. I haven’t received any financial help during my life’s journey so it has been a long and exhausting financial road of one step forward and three (not two) steps back.

While my success is a personal situation, I also know that it’s not just about me. My success is an example for others. Kind of like when you travel to a foreign country and find yourself in the position of ambassador. That’s how I feel sometimes-that my success is a reflection of my mother’s hard work, my grandparents, and so on and so forth.

As I nervously wear the hat of financial ambassador, I find that I want to be an example, that I want other people to believe that they too can be debt free, grow their money, and have the life that they dream of. With all of the crap that I’ve dealt with to get through it and be where I’m at now makes me feel like a badass.

So, when I see that my net worth has surpassed 6 figures (even with my debt) I it is an amazing feeling and accomplishment.

But. With my debt paid off I would have a much larger net worth. The debt is such a drag on me in so many ways.

So, while I feel good about reaching this milestone I still feel a little “meh” about it. The debt has been such a drag on my life in so many ways I just can’t pay it off quickly enough.

There are moments when I’m hard on myself and I feel like a failure, a disaster, a hot mess. Then, I let it go and understand that I’ve done the best that I could with the information and knowledge that I had at that moment in time.

I know a heck of a lot more now and am dealing with a different set of cards.

Game on.

Latest posts by Michelle (see all)

- How to Design a Boycott Strategy That Works for YOU - 6 February, 2025

- How Work Policies Against Black Women Birthed a Love of the Soft Life - 20 March, 2024

- How Taylor Swift’s IP Victory Could Change the Business of Music - 28 February, 2024

I understand that meh feeling. I have a great net worth…if I was 30 and not 43. That’s why I almost don’t share that number, because I don’t want people to forget that it’s nowhere where it should be at my age. And it makes me wonder, under my current circumstances, how to make the grow a lot bigger at a faster pace.

I have some great components in place but until the debt is paid off my net worth won’t reflect that. I should say that I am very, very grateful for what I do have and I know that I’m doing better than a lot of people…I just have a certain amount that I feel I should be at and I’m impatient with myself and annoyed that I feel so behind. I can make up the difference, it’s just going to take time and diligence-like every other freaking thing that I do. Why can’t we just push the “easy” button?

I can relate as well. I am proud of where we are financially but I really do regret some big financial faux pas I made in my twenties. I have a lot of catching up to do in order to reach certain goals I have. I could have been pretty close to FI now if I had played my money cards a lot better. But what is done, is done. Feel good about your progress and know that once the debt is gone, you’ll be in an even better position!

I am still paying for my faux pas and I’m over it. I’m trying to focus on the good financial decisions that I’ve made because I’ve made more than it seems. You’re right though, what’s done is done. Am just slowly chipping away at the debt and each time it gets noticeably lower I celebrate!

I remember when I was really heavily in debt and I finally hit a net worth of $0. I was ecstatic… in contrast, now that I have a net worth of $230K, I don’t feel as accomplished because there is no real end in sight.. if that makes sense. At my age, I feel like I should have more considering my earning potential but then you factor in my laziness and.. well..

Hard to say. I beat myself up over this so much, and then I try to say: But it’s what you chose as your life.

.. I guess in a roundabout way, I’m trying to say: Don’t feel bad about it. You will get that debt cleared and then your net worth can proudly boast: $0 in debt!

It’s weird because I still see the debt and so I found it really difficult to get excited about my net worth because the debt is still there. At this point I’m just going to let all expectations go and just slowly chip away at it. What else can I do? I could also admit that I dragged this along longer than I would like…and that’s my fault 🙁

I think you should be proud all busting through stereotypes like a ninja and it’ll take us a while before we hit above 6 figures so I think you rock. 🙂

Thanks Cat for your encouragement. I put a lot of pressure on myself and want to accelerate my debt repayment/net worth growth. Until then I will give myself a break 🙂

Reaching a six figure net worth regardless of debt is absolutely an accomplishment. We all have things to work on, but you’ve taken charge of your life, and been successful. Keep up the good work, Michelle!

Thanks for the kind words! It’s hard because I feel like I’m behind where I “should” be. I’m just going to continue to focus and make things happen.

I think you deserve a congrats anyway! I’ve read that the 6 figure mark IS a real milestone and it’s when investments really start to pick up compounding speed. So way to destroy some crappy statistic and make the average just a little higher ;o)

Thanks Mel! It IS a crappy statistic and I am glad that I’ve made the progress that I’ve made so far. I can’t wait for the compounding to really begin.

Girl I am so happy for you! I will celebrate for you! I appreciate this post (passes you an imaginary bottle to pop). Prior to embarking on my journey I never gave much thought about my net worth. I’m just happy to have a network over 10K but I really have work to do.

Keep up the greta work <3

Thanks Tonya! Appreciate the imaginary bottle-lOL! We will both rock this and have amazing net worths. I think that a lot of people get caught up in the day to day business of living and lose track of things like: net worth, savings, investing,etc. But, the only way to win financially is to participate in all of those financial arenas. Looking forward to reading about your journey.

Even though you still fee the debt weighing you down, passing the six-figure net-worth mark is a big milestone. Congrats!

I am just really over the debt. That is my next project for 2015. I think I just need to keep things in perspective-and THANK YOU! for your encouragement and congrats.

Seems like a great milestone to me. I’d like to tell you “good job” no matter how you feel about it.

Thanks Andy, I think it’s easy to lose perspective and forget that it’s still a pretty awesome achievement. I just feel like I need to catch up to my peers. I need to mellow out and just enjoy the moment.

Congrats on the accomplishment and continued success!

Thanks Brian! I plan on continuing to work hard and hopefully get that number to grow!

Congrats on your net worth number! That’s great I have a lot of mixed feelings about my debt. I wish I wouldn’t have made any of the mistakes that I made financially.

I do too, but it’s too late now. All I can do is focus on fixing the problem. It’s just taking FOREVER. I think I have another 3 years to go. Sigh.

“I let it go and understand that I’ve done the best that I could with the information and knowledge that I had at that moment in time” — that is my mantra! It’s so true. There’s no amount of beating yourself up over the past that’s going to make the future any better. Keep plugging away at that debt!

There is a point where looking at my past decisions just wasn’t helpful. So, I had to relax and move forward. I wish some of my decisions were different-but they weren’t and I don’t have Harry Potter’s time turner so that I can go back in time and change things. So, I will continue to pay off my debt and focus.

It will take us quite some time to reach a 6 figure net worth but we are on the right track. Our student loans are killing us but we are paying of things slowly. It is certainly a great feeling to be debt free. Thanks for the awesome post Michelle!

One day I will read your debt free post!! It’s coming soon. I, too, am getting rocked by my student loans. Once those are tackled things will be great. I am thinking another 3 years. Sigh.